There are new settings that allow you to create a wholesale transfer invoice in adilas. These settings accomplish three things:

1) You can sell inventory at cost without manipulating the items in the cart.

2) You can add a mark-up for wholesale without manipulating the items in the cart.

3) If you are in a state that reports to METRC, your sale will be marked ‘e’ for exempt, so this sale will not be submitted to METRC.

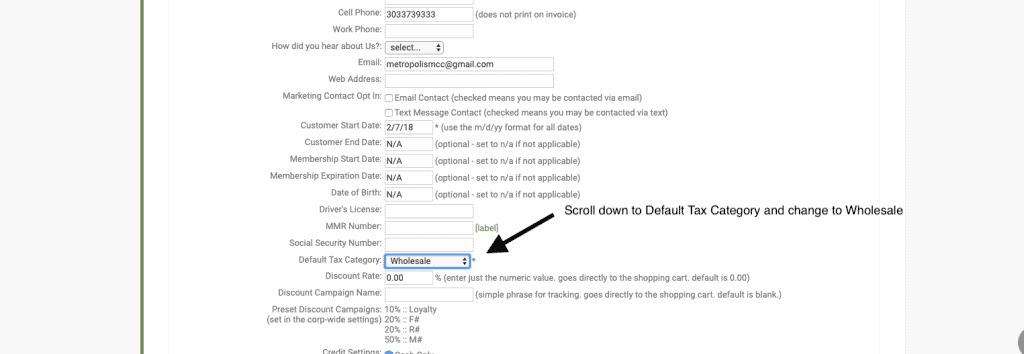

First create your customer. The main setting you need to designate them as wholesale is when choosing their default tax category, you must select ‘Wholesale.’ Essentially any customer can be used as wholesale, as long as this tax category is chosen.

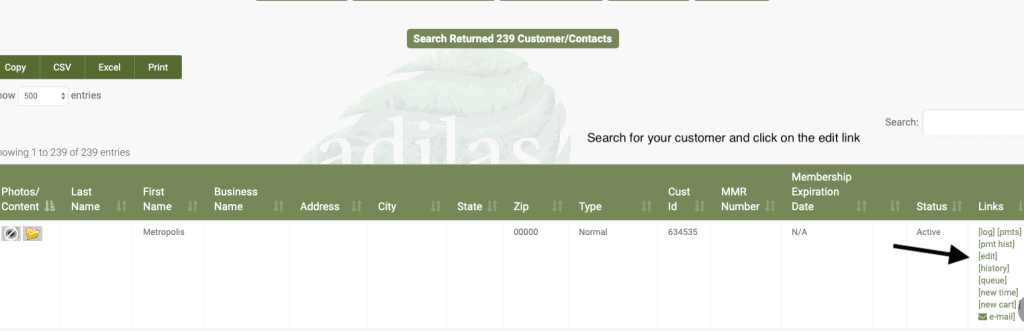

If you are editing a current customer, search for your customer and click edit.

Navigate to the default tax category, and flip to ‘Wholesale.’ Click edit.

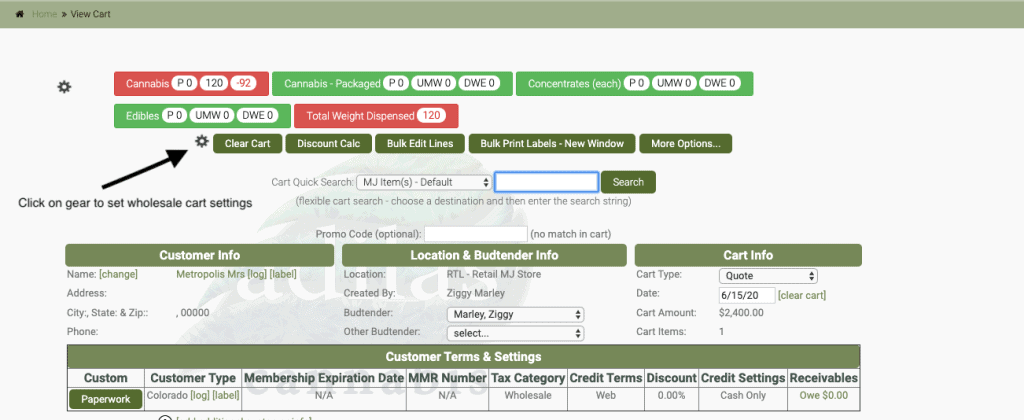

Now you can start a new cart with your wholesale customer.

Once you are in the shopping cart, go to the gear at the top left of the page, just to the left of the ‘Clear Cart’ button.

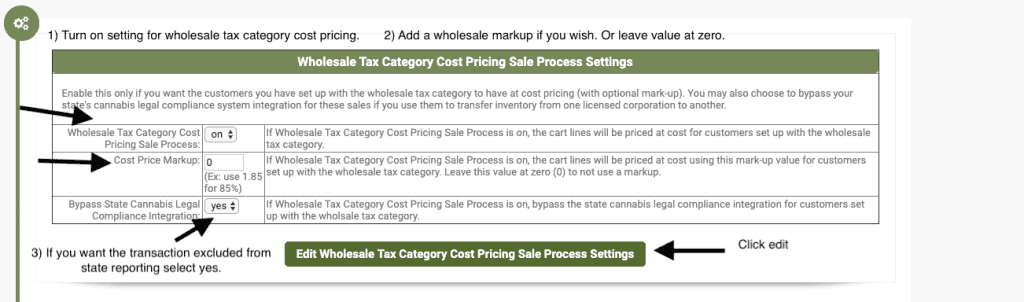

You have three settings you may set. They will not change unless you return to this page and edit them.

The first setting determines if you will use this new function. If you wish to use this function, change to ‘on.’ The second setting determines if you will charge a mark-up on your wholesale. If you wish to charge a 20% markup, for example, you can enter that percentage here. The third setting relates to state reporting. If you do not have state reporting, you will leave this set to ‘no.’ If you do, then you would flip to yes. This will keep your wholesale transfer from being received as a regular sale.

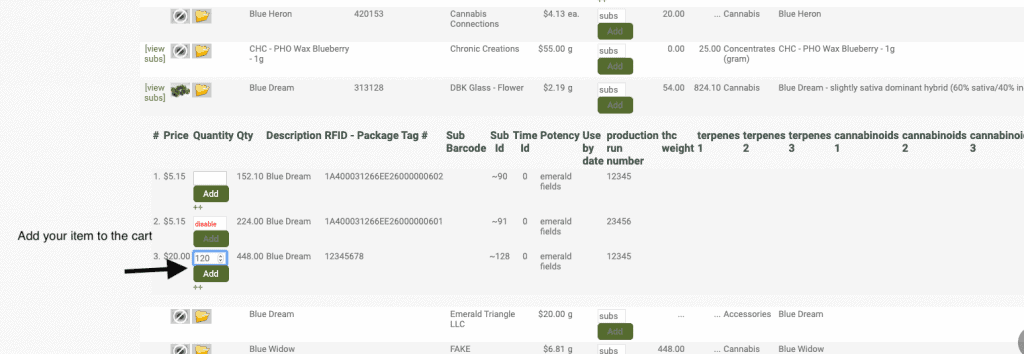

Now add your product to the shopping cart. Please note that the price of this item is $20.00.

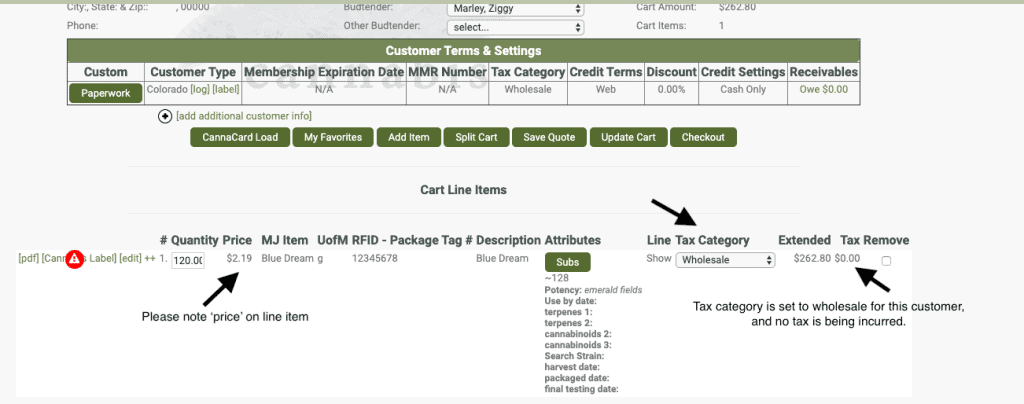

Once added to the cart, you will see that the price is $2.19 and there is no sales tax being calculated. We did not apply a mark-up so the price is just simply the cost.

Now you can complete your sales transaction, and this invoice will be marked as ‘e’ or exempt from state sales reporting.

As always, please feel free to reach out to your consultant, Technical Support at 719-966-7102, or email support@adilas.biz if you have any questions, concerns, or suggestions.