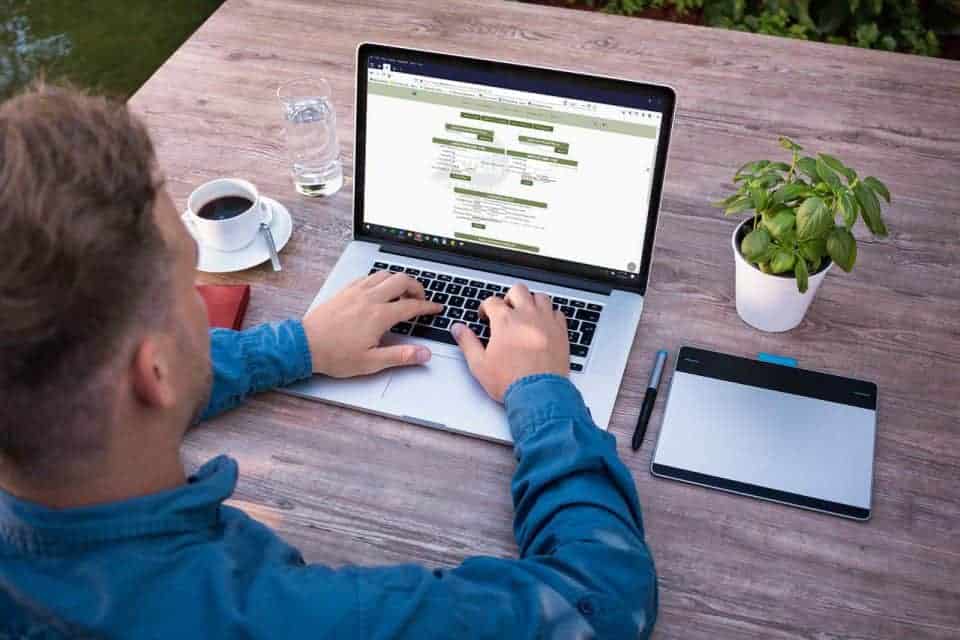

When running your payroll at the end of the year, it is important to pay attention to the “Use Tax Year” drop down list to ensure that your payroll is included with your liabilities for the month/quarter.

For example, say you are calculating your payroll for 12/16/19 through 12/31/19. If you were physically doing this on 12/31/19, then the “Use Tax Year” drop down would still default to 2019. BUT, if you calculate this payroll on 1/1/20 or later, then the year is going to default to the current year, which is 2020. In order for that payroll to be included with your December 2019 payroll liabilities, you need to change the year back to 2019.

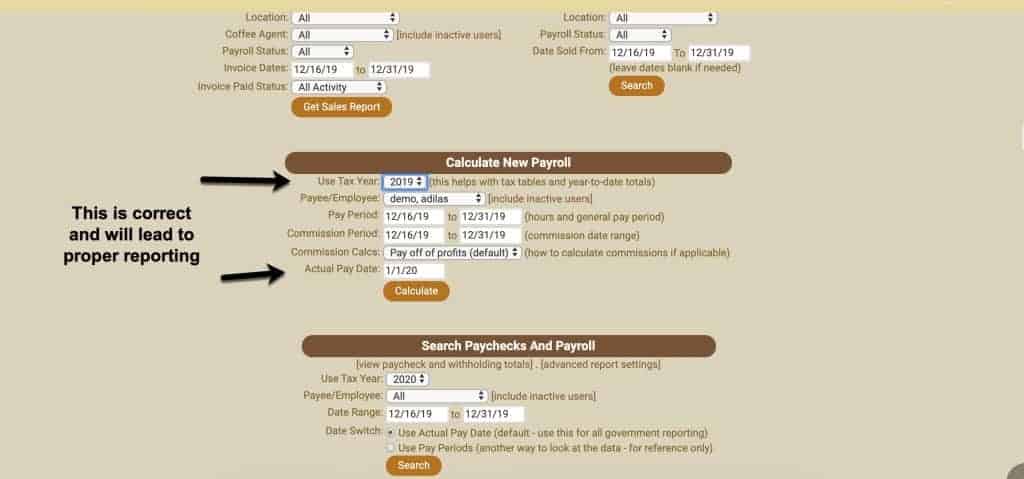

From the payroll homepage, scroll down to calculate new payroll. Make sure your “Use Tax Year” is for the year of the actual payroll. If the payroll is from 2019, then the tax year needs to be the same.

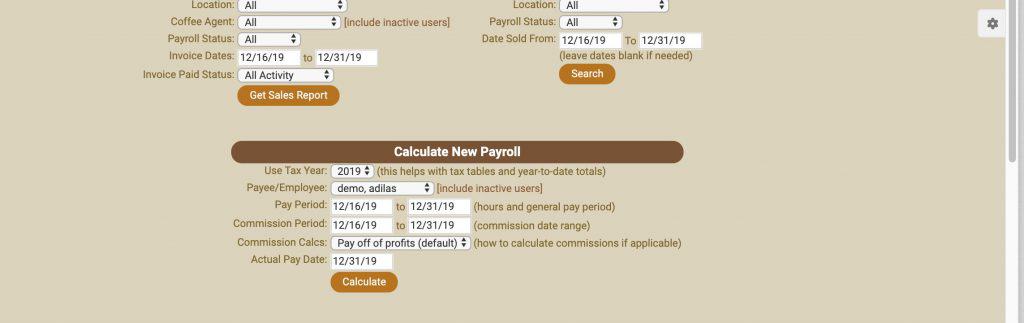

If you don’t actually run the payroll until the next calendar year (ie 2020) you will need to manually change the drop down tax year to 2019. This image demonstrates what NOT to do! This will lead to an incomplete payroll liabilities report.

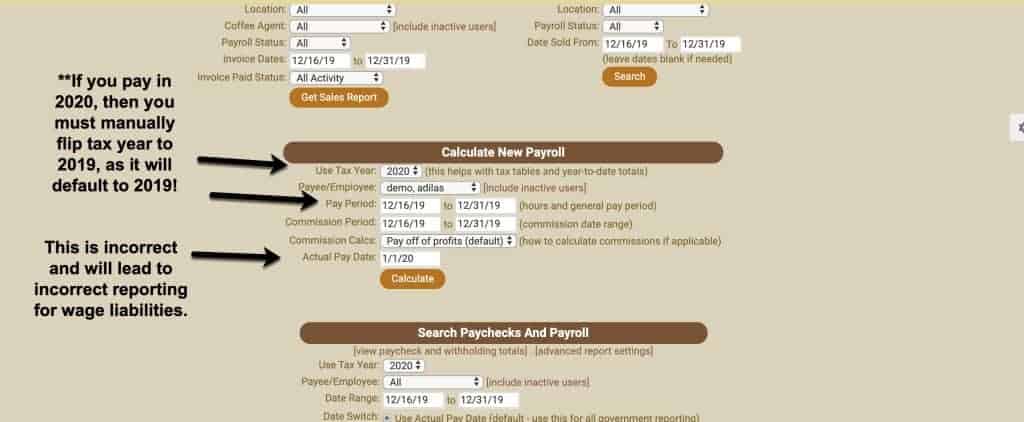

As you can see in the example below, the payroll is being calculated in 2020, but they flipped the year to 2019. This will create the proper wage withholding report.

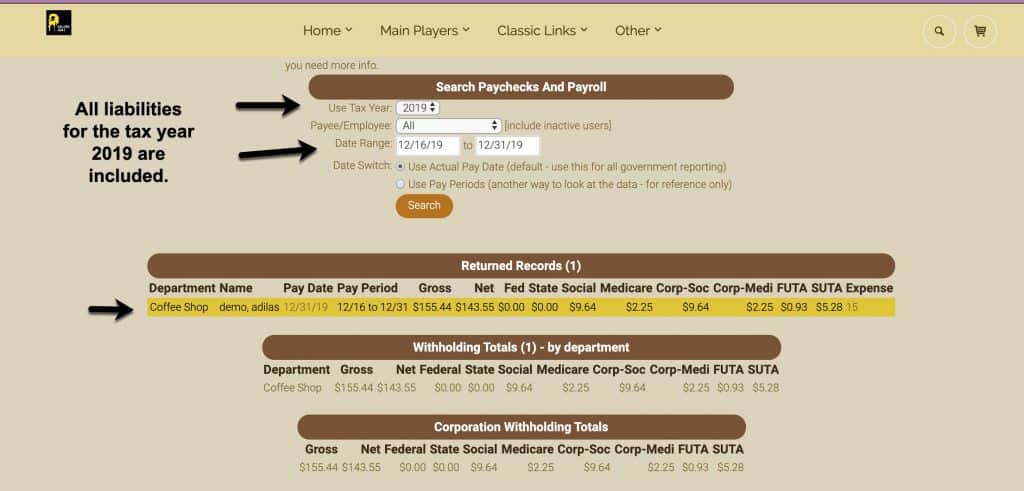

Immediately go and run the payroll report for the pay period to confirm that you processed it correctly. Below the proper year has been selected.

Now you can see the report is complete.

As always, please feel free to reach out to your consultant, Technical Support at 719-966-7102, or email support@adilas.biz if you have any questions, concerns, or suggestions.