Most Adilas users will not notice anything different about these upgrades to the loyalty points program, but those who want to track their liability will be interested in these developments, as well as those who aim to comply with new tax rulings regarding loyalty and rewards programs released this March 2020.

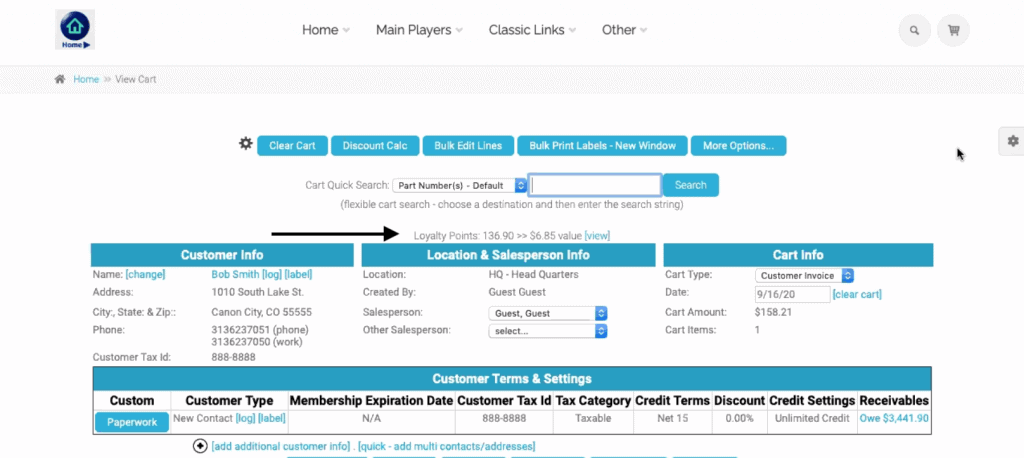

When the user creates an invoice for a loyalty program participant, they will still see the points and their value on the invoice.

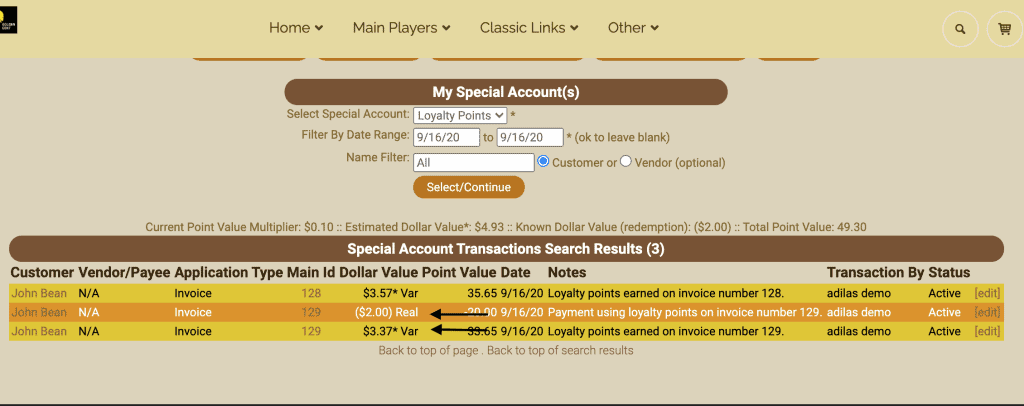

Once the invoice is final, the points earned will be recorded in the database as an actual cash value, whereas before they were stored as a variable value that wasn’t calculated until they were used.

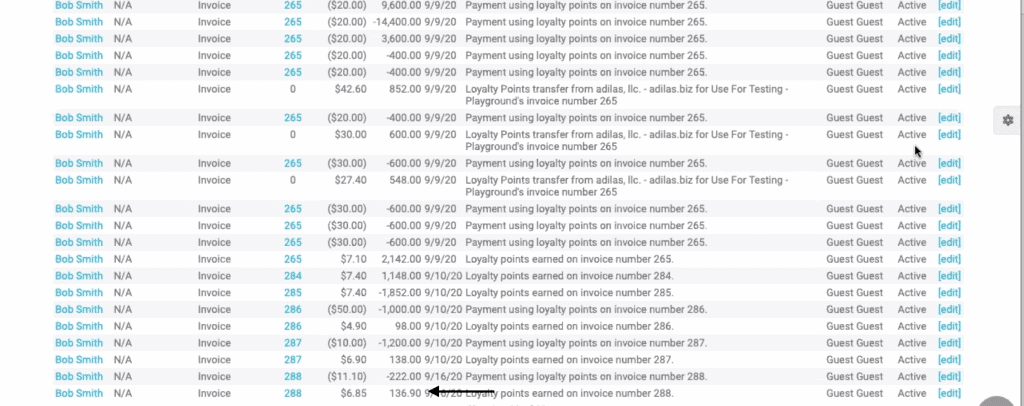

Before:

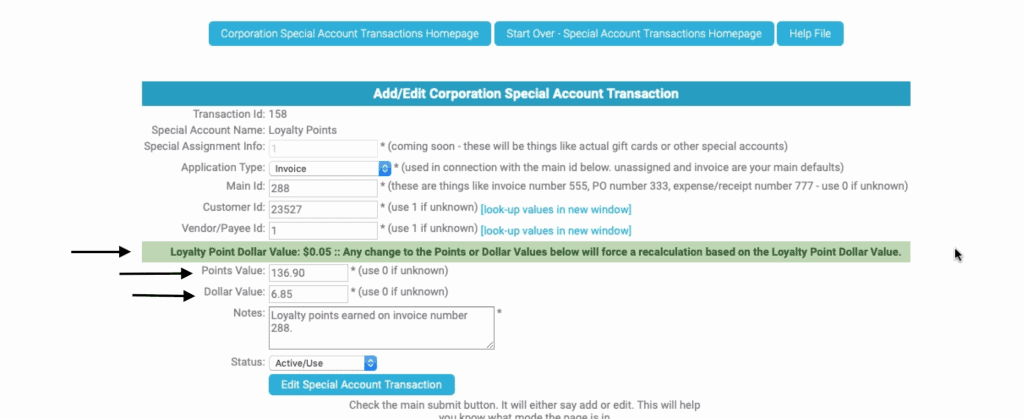

After:

These variable values will be retroactively updated by the new code, so all users will now see actual cash values when reviewing old transactions.

Additionally, when editing transactions, if a user changes the point value, the dollar value will automatically recalculate. The same thing will happen if the dollar value is edited.

This new update complies with the new March 2020 IRS ruling for GAAP accounting which states that all loyalty and rewards programs must follow an ACV (actual cash value) principle. This means that rewards value must be memorialized at the time of the intention. Essentially, once the reward is earned, it must be stored at ACV.

When the reward is redeemed, the redemption value is the total amount of the ACV. This ensures the customer is going to be rewarded based on the actual amount earned.

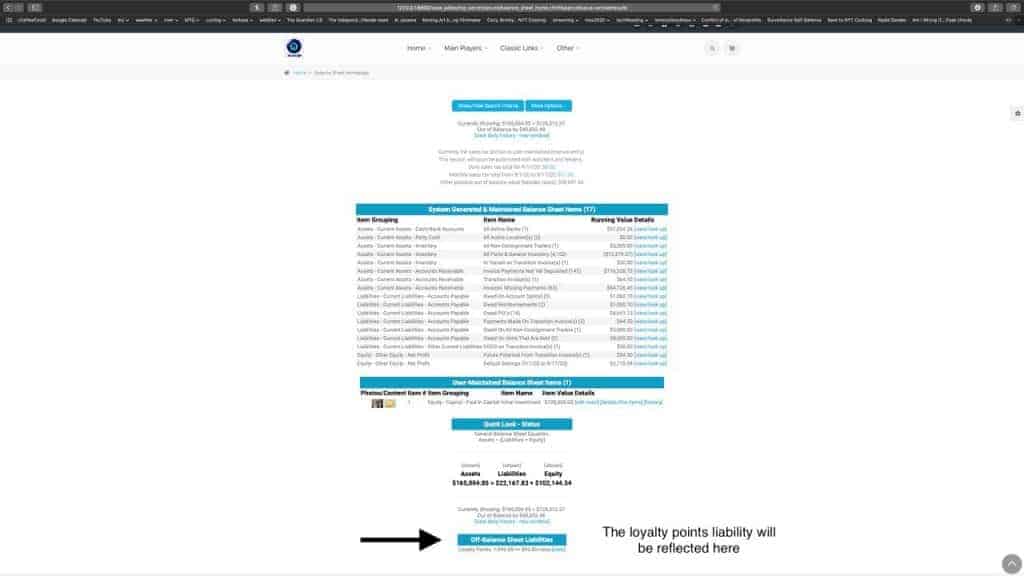

Additionally, the system now includes the total liability of those compounded ACV’s on the balance sheet.

As always, please feel free to reach out to your consultant, Technical Support at 719-966-7102, or email support@adilas.biz if you have any questions, concerns, or suggestions.