The IRS rolled out a new 1099 for the tax year 2020 for non-employee compensation. This is called the 1099 NEC. Previously this income was reported on the 1099 MISC.

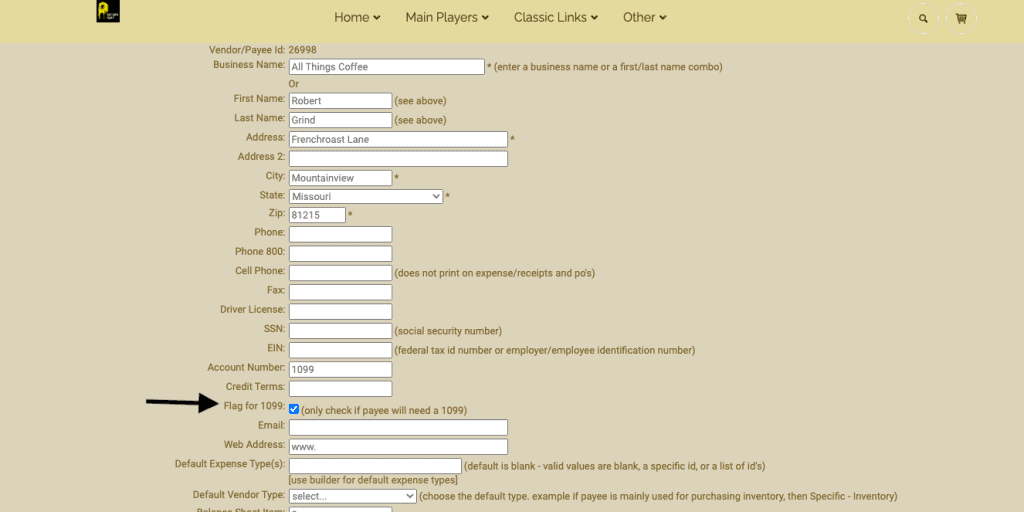

Adilas has made both of these forms available to its clients. In order to populate these forms, you will need to ensure the vendors have a check box in their profile to flag them as 1099 vendors. Go to the vendor profile and click edit. Scroll down and check the box for “Flag for 1099” if it isn’t checked.

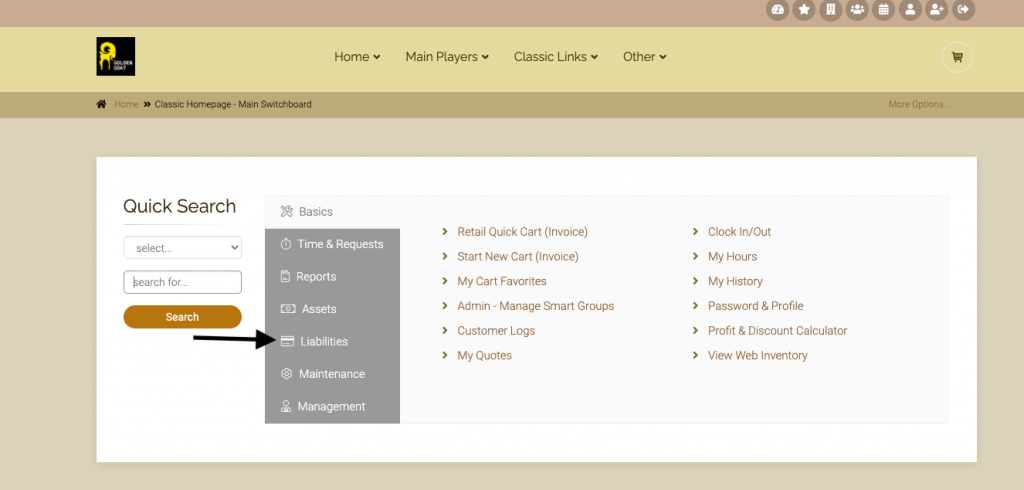

Once the vendor has been flagged, from the Classic Homepage click on Liabilities.

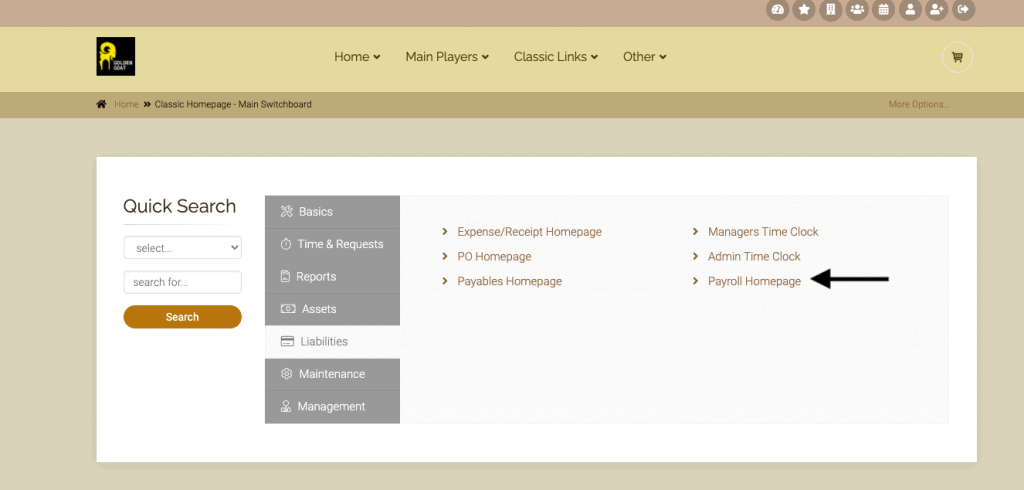

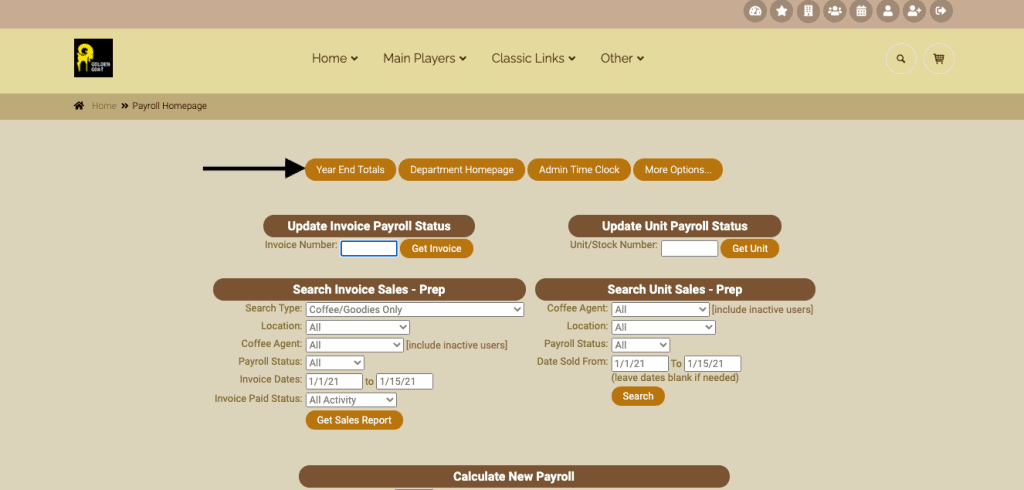

From here click on the Payroll Homepage.

At the top of the page, click on Year End Totals.

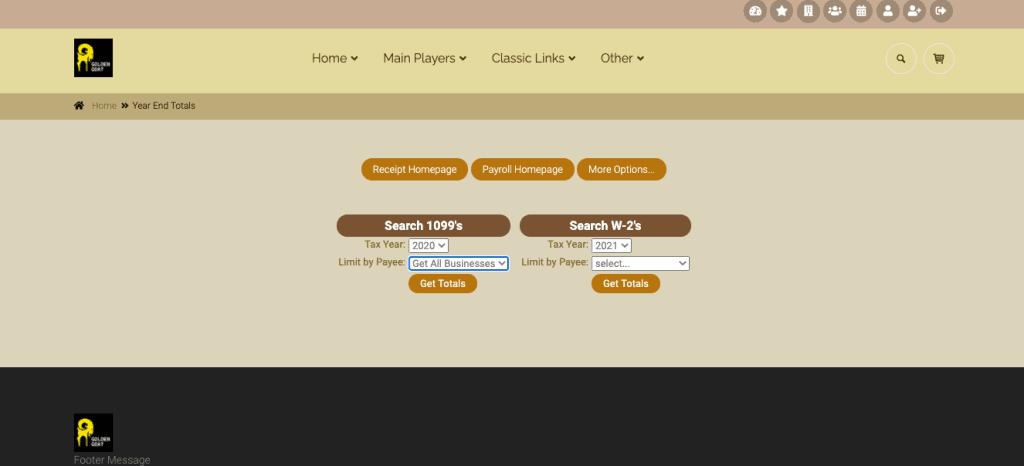

Search 1099’s on the left. Select the appropriate tax year and limit by payees.

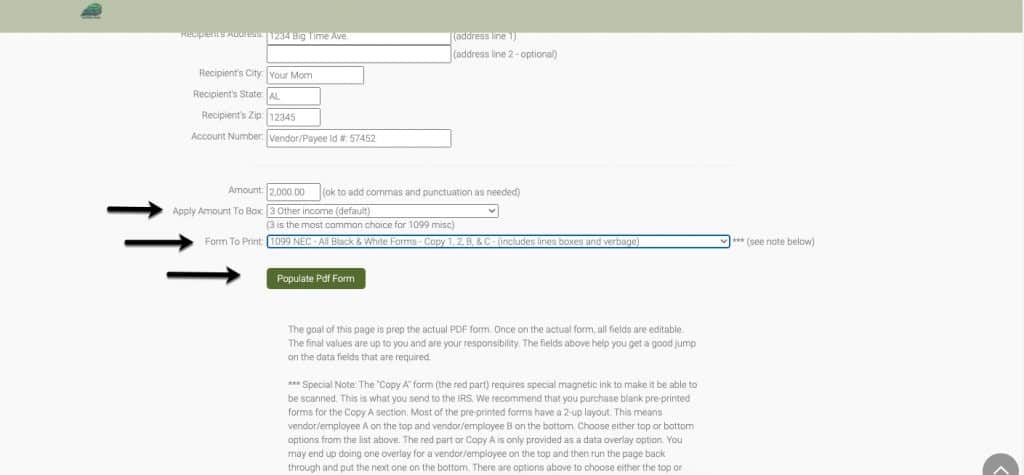

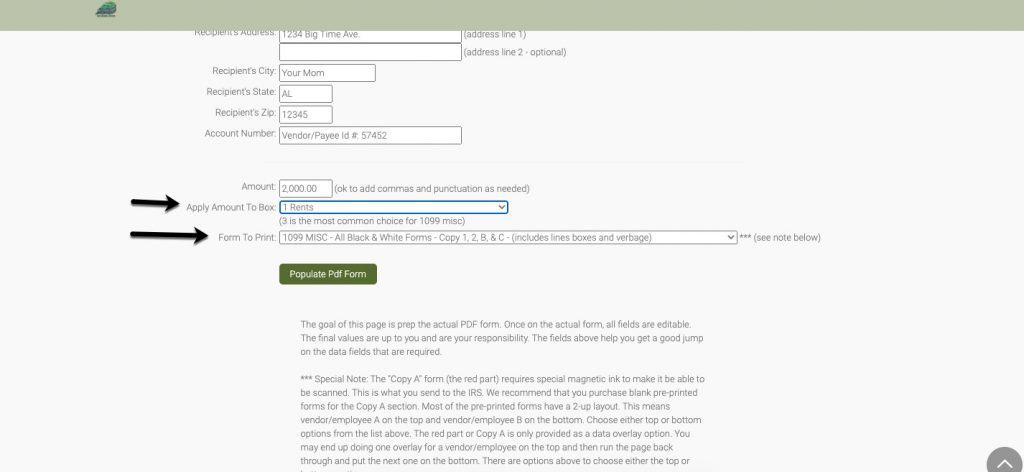

Scroll down to the bottom of the form. If you are using the NEC, which is the new 1099 for payments to a subcontractor, choose number 3 other income as the box (default) and choose 1099 NEC from the drop down list of forms to print.

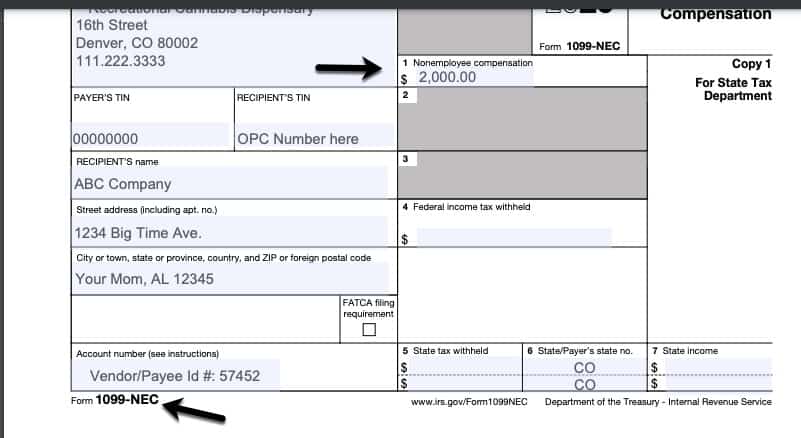

Once you populate the pdf you will see that the payments are in the Non-employee compensation field.

If you are using the 1099 MISC to report other payments, such as rent, choose the appropriate field from the drop down list, and the 1099 MISC from the form drop down.

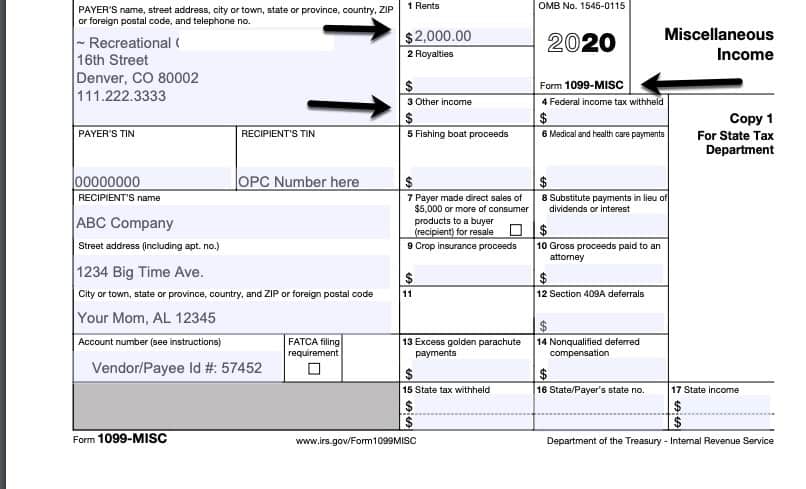

When you populate the pdf, if you chose rent as the field, you will see it has been populated with your payments.

Here is some information you may find useful:

Specific Instructions for Form 1099-NEC

File Form 1099-NEC, Nonemployee Compensation (NEC), for each person in the course of your business to whom you have paid the following during the year:

- At least $600 in:

- Services performed by someone who is not your employee (including parts and materials) (box 1);

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish (box 1); or

- Payments to an attorney (box 1). (See Payments to attorneys, later.)

You must also file Form 1099-NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment.

Specific Instructions for Form 1099-MISC

File Form 1099-MISC, Miscellaneous Income, for each person in the course of your business to whom you have paid the following during the year:

- At least $10 in royalties (see the instructions for box 2) or broker payments in lieu of dividends or tax-exempt interest (see the instructions for box 8).

- At least $600 in:

- Rents (box 1);

- Prizes and awards (box 3);

- Other income payments (box 3);

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate (box 3);

- Any fishing boat proceeds (box 5);

- Medical and health care payments (box 6);

- Crop insurance proceeds (box 9);

- Payments to an attorney (box 10) (see Payments to attorneys, later);

- Section 409A deferrals (box 12); or

- Nonqualified deferred compensation (box 14).

You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment.

As always, please feel free to reach out to your consultant, technical support at 720-740-3076, or email support@adilas.biz if you have any questions, concerns, or suggestions.