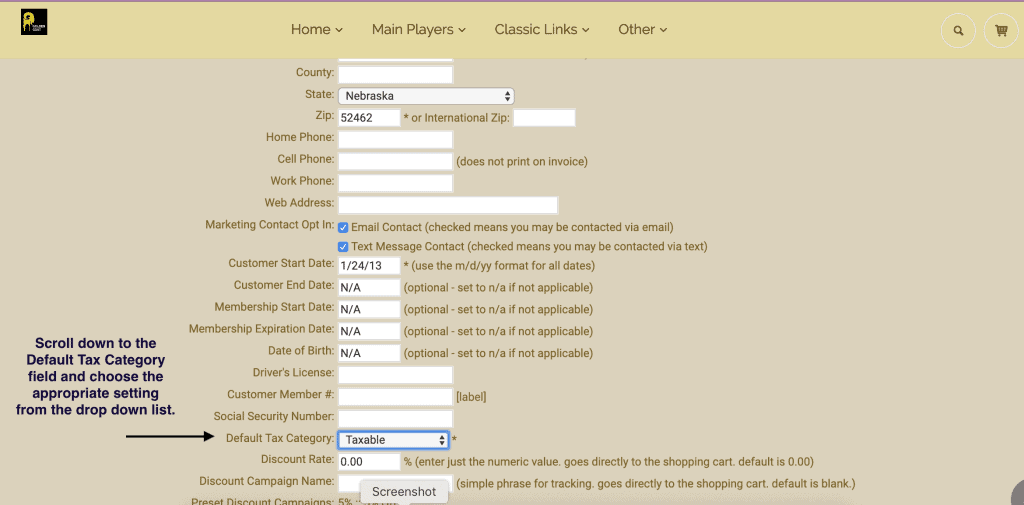

Each customer in your system may be assigned to a tax category. Some options include normal taxable, wholesale, resale, and government. Previously, the tax category showed up in the shopping cart, and could be manipulated on the fly if needed.

The new code allows for the customer tax category to virtually stick all the way through the shopping cart. The new code also helps after the fact, if a new item is added after the invoice has been created.

Essentially, even if your items are set as taxable or tax included, if you have specified another tax category to a customer, it will override the item’s setting.

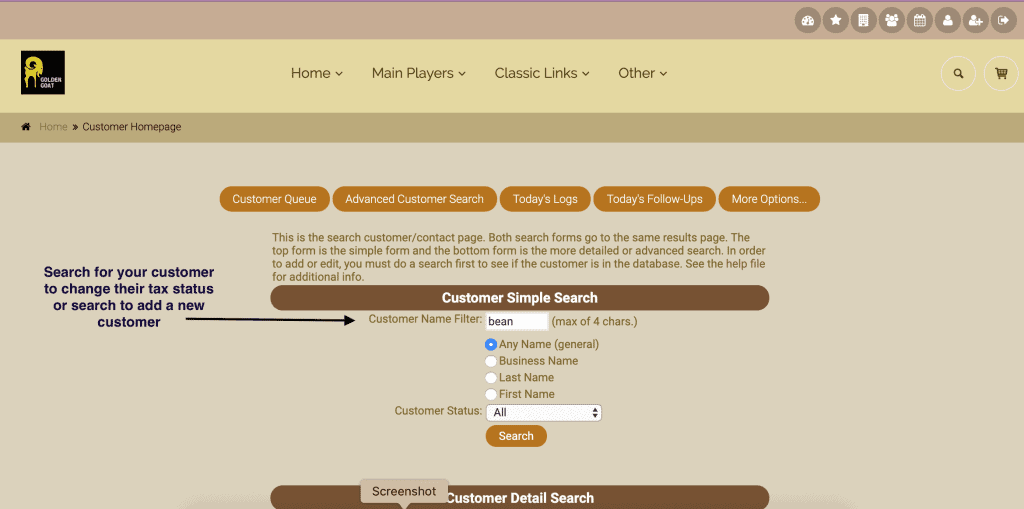

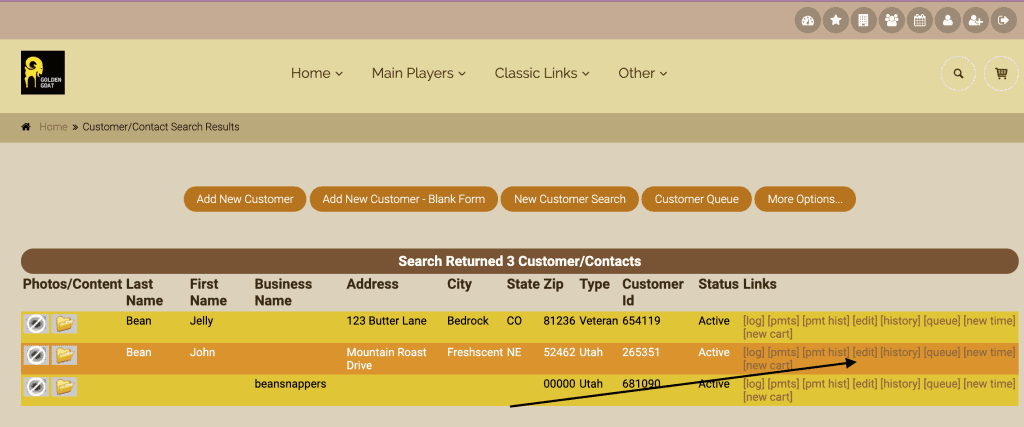

First, search for your customer to change their tax status, or to add a new customer to the database.

Click on edit customer to access their information. Change the tax status from the drop down list and edit customer.

This also works in eCommerce. If a wholesale customer makes an online order and/or invoice, the system will apply the wholesale tax category (no tax) for that customer.

*As a small side note, they may not see the proper tax rate until they login, but it will flip before doing the final save as quote/order or full invoice checkout. The key is letting the cart know who the customer is. Once the cart knows that, it will try to follow suite based on the customer tax category.

As always, please feel free to reach out to your consultant, Technical Support at 719-966-7102, or email support@adilas.biz if you have any questions, concerns, or suggestions.