Now when a user voids a deposit or expense receipt, it will automatically be voided (zeroed out) on the balance sheet. Below will demonstrate what this process looks like with an expense receipt. The same steps will be taken with a deposit.

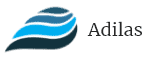

Create an expense receipt and allocate it to the balance sheet as usual. See that the expense receipt is allocated to bsi 2. **You must enter the bsi number in the line item at this time or you will not be able to automatically void it from the balance sheet later if necessary. One way to ensure that this number is always entered for the line item is to set these defaults in the chart of accounts (expense types/deposit types). If you need help setting these up please consult the update called “How to Add Balance Sheet Item Numbers to the Chart of Accounts.”

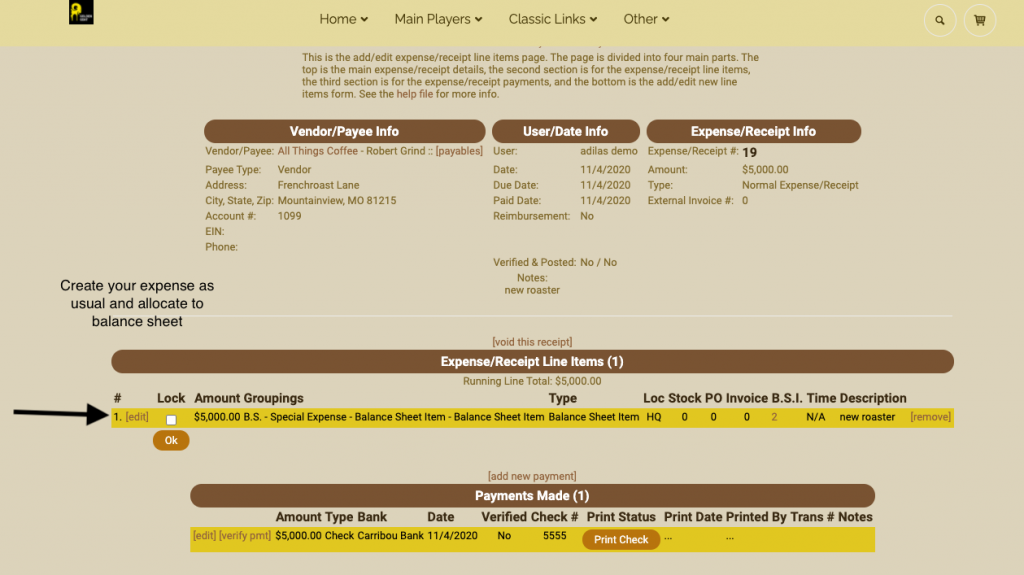

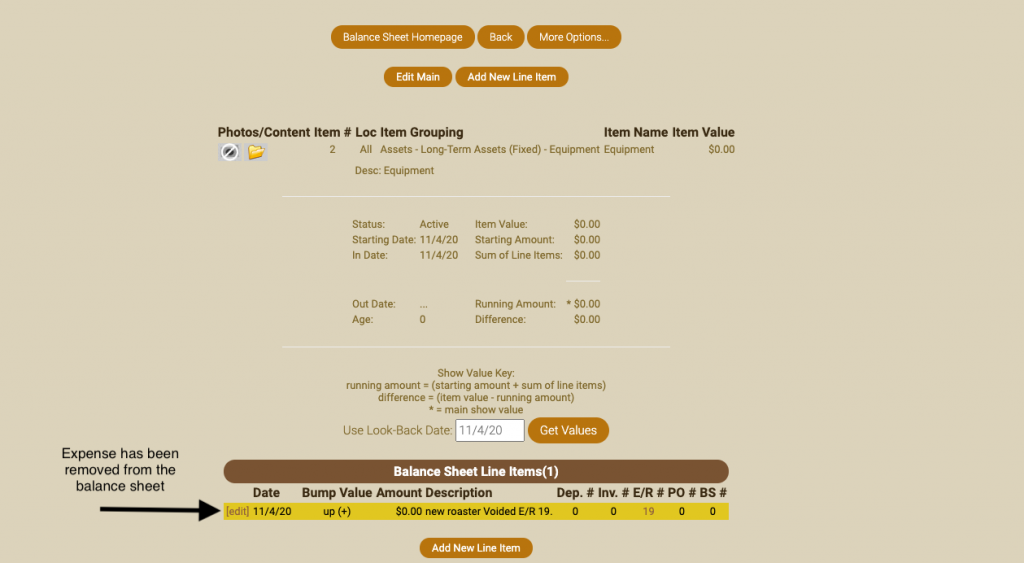

Notice below the expense receipt is on the balance sheet.

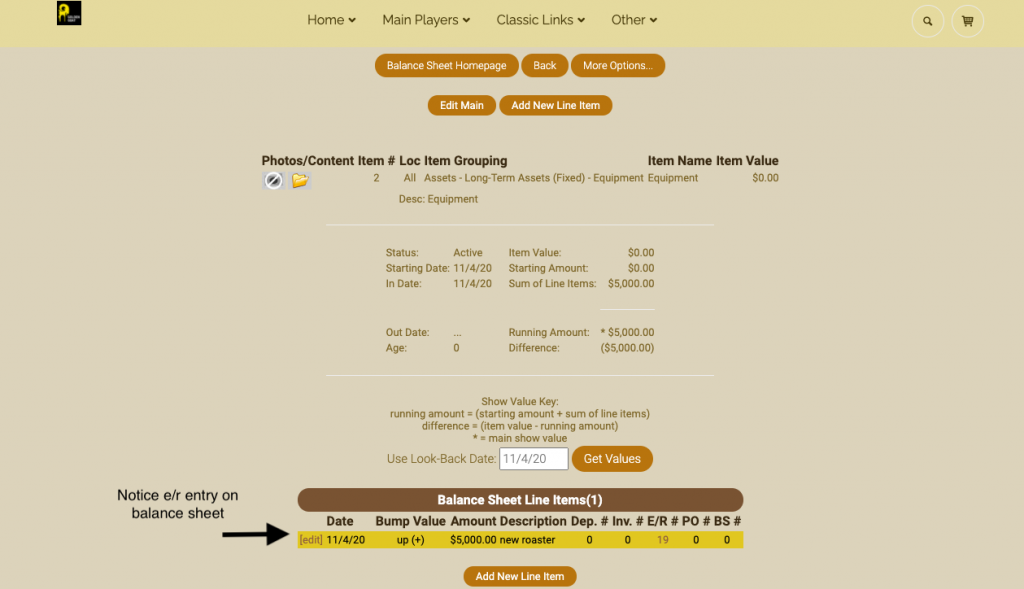

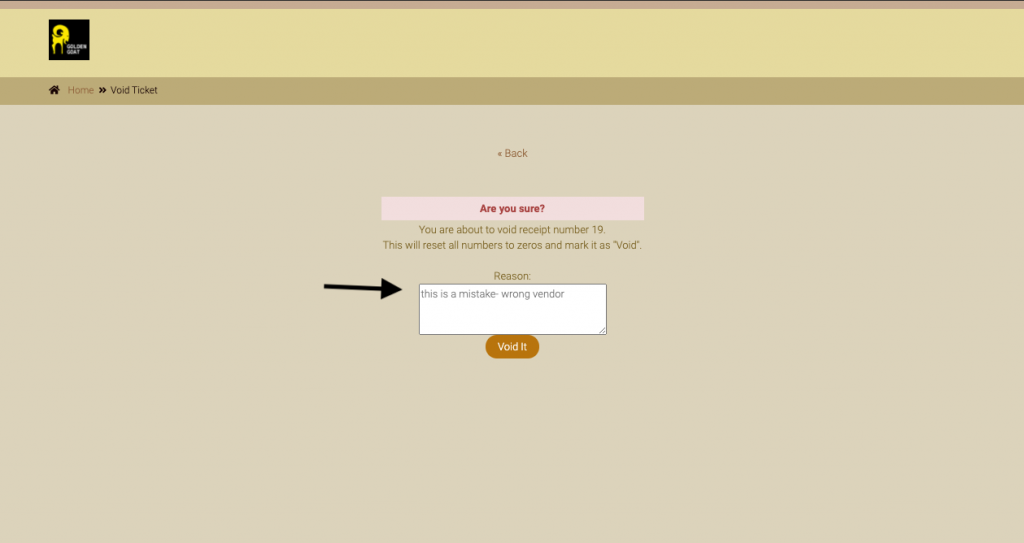

To void this entry, return to the expense receipt (in this example it is expense receipt 19).

User will be prompted to confirm the void process.

Return to the balance sheet and confirm that the entry is zeroed out.

The same function exists for deposits. In order to void a deposit from the balance sheet, simply void the deposit itself and it will be zeroed out from the balance sheet.

**A few important details to pay attention to:

1) If you have multiple line items allocated to the balance sheet and void the expense receipt, it will void all of the lines.

2) In order for the auto void function to work, the balance sheet item number must be included in the expense receipt or deposit upon creating it. To ensure that this happens every time, we recommend setting up your chart of accounts to automatically include the balance sheet item number. (Please see news and update on how to add balance sheet item numbers to your chart of accounts.)

As always, please feel free to reach out to your consultant, technical support at 719-966-7102, or email support@adilas.biz if you have any questions, concerns, or suggestions.