07/03/17 – *** Note: This update has been delayed with additional functionality being added. ***

Some states are starting to require excise tax be added to the retail purchase. This tax must be calculated on the original salesprice.

This additional logic will allow tax on either list price or discounted price and should resolve possible upcoming tax requirments.

We apologize for the delay.

Colorado Recreational Dispensaries

The 10% CO Cannabis tax field needs to be increased to 15%.

The 2.9% CO State tax needs to be limited to non cannabis items.

Give us a call at 719.439.1761 or 719.221.6661 if you need help.

- Sales Tax Update

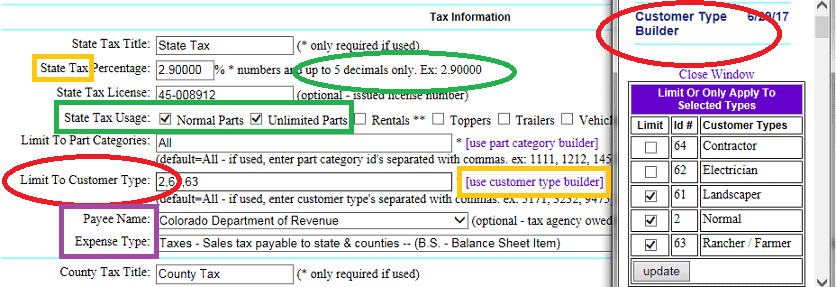

- Total of 13 Unique Tax Fields (5 additional new fields)

- Sales Tax Rates now allow 5 decimals

- All taxes per line item are calculated to 5 decimals

- Limit Taxes per Inventory Type and by Category

- Limit Taxes per Client Type

- Assign Vendor Payee

- Assign Chart of Account Name/Number

- Tax Titles are Dynamic